Ubisoft Stock Halt: What Happened and Reddit's Take

Ubisoft's Trading Halt: Is This the Calm Before the Storm, or the Silence of a Tomb?

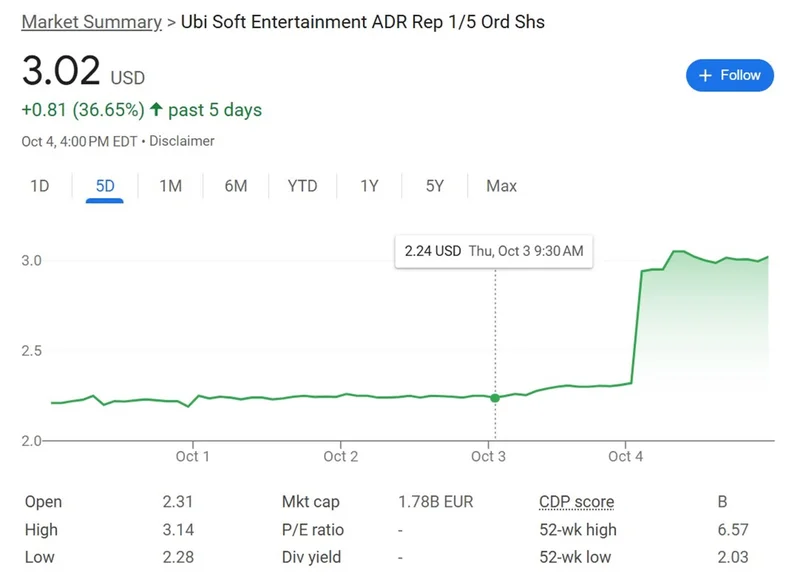

Let's cut the marketing fluff: Ubisoft's in a mess. Trading halted, earnings delayed, AI art sparking outrage – it's a perfect storm of bad news. But is it truly the end times, or just a particularly turbulent patch for a company that's seen worse? As a former hedge fund data analyst, I'm less interested in the drama and more interested in what the numbers aren't telling us.

The immediate trigger, of course, is the delayed earnings report and the subsequent trading halt. CFO Frédérick Duguet's internal memo talked about limiting "unnecessary speculation," but let's be real: halting trading guarantees speculation. It's like telling people not to think about a pink elephant. What could be so bad that it requires a market-wide pause? Project cancellations are piling up – a Civil War Assassin's Creed, a sci-fi title, even a new Splinter Cell got the axe. That's a lot of R&D down the drain. And then there's the removal of the Assassin's Creed director, described as "contentious."

Acquisition Rumors: Smoke and Mirrors?

The acquisition rumors are flying, naturally. Tech4Gamers, citing an insider, claims "someone" is serious about buying Ubisoft, and that someone isn't US-based. Tencent and Sony are the usual suspects, given Tencent already owns 25% of Ubisoft's Vantage Studios IP subsidiary. The stock-analysis sites are already throwing out dates (November 20th), but those are projections, not official guidance.

Here’s the problem with acquisition rumors: they're almost always based on conjecture, not concrete data. A viral tweet claiming "serious M&A discussion" is hardly a basis for investment decisions. It's noise, not signal. What we do know is that Ubisoft's Paris-listed shares are down roughly 50% year-to-date. That's a significant drop. But is it a fire sale price, or a reflection of deeper structural issues?

Ubisoft UK is warning of falling sales, attributing it to fewer new releases and a shift in player behavior – people are playing fewer games, but playing them for longer. (The industry term is "engagement," but I prefer plain English.) UK physical software sales dropped about 35% in the year to March 2025. Hardware sales fell around 25%. The numbers paint a clear picture: the market is contracting, and Ubisoft is feeling the squeeze.

The AI Problem: A Litmus Test for Player Trust

And then there's the Anno 117 debacle. The game itself is getting decent reviews – "sumptuous Roman sandbox," "atmospheric," etc. But the AI-generated loading screen has triggered a fan revolt. PC Gamer reports that Ubisoft pushed an updated version, but it looks suspiciously similar, raising questions about the extent of AI use. One writer even stopped playing the game entirely.

Ubisoft's statement – that the image was a "placeholder asset" – is corporate-speak for "we messed up." They claim AI is only used for "iterations, prototyping, and exploration," but the damage is done. The core issue isn't just the loading screen; it's the erosion of trust. The Reddit threads are split, but the negative sentiment is palpable.

This whole AI art fiasco feels like a metaphor for Ubisoft's current situation. A company trying to cut corners, streamline production, and maximize profits, even if it means sacrificing quality and alienating its fanbase. Is this a sustainable strategy? I seriously doubt it.

Meanwhile, Rainbow Six Siege is having a moment. M80 won the Munich Major 2025, securing a spot at the Six Invitational 2026. The developers are even taking a hard line against cheaters, with one saying "fk 'em." (That's a direct quote.) The new season, Operation Tenfold Pursuit, promises twice-weekly security updates and improved anti-cheat tools. It’s a classic good news/bad news scenario.

To cap it all off, Ubisoft is running a massive Black Friday sale, with discounts up to 90% and a free copy of Immortals Fenyx Rising. It's a desperate attempt to monetize the back catalog and boost Ubisoft+ subscriptions. But deep discounts are a double-edged sword. They drive short-term sales, but they also devalue the brand.

So, What's the Real Story?

Ubisoft is at a crossroads. The trading halt, the delayed earnings, the AI backlash – they're all symptoms of a deeper problem. The company is trying to balance cost-cutting with creative ambition, but it's not clear they can pull it off. The next few days will be crucial. Will the acquisition rumors materialize? Will the earnings report reveal a financial black hole? Will Ubisoft address the AI issue in a meaningful way? Until then, the silence is deafening.

Tags: ubisoft stock

Obama Under Scrutiny: What's Happening?

Next PostMicrosoft Stock: Price Fluctuations and Market Sentiment

Related Articles